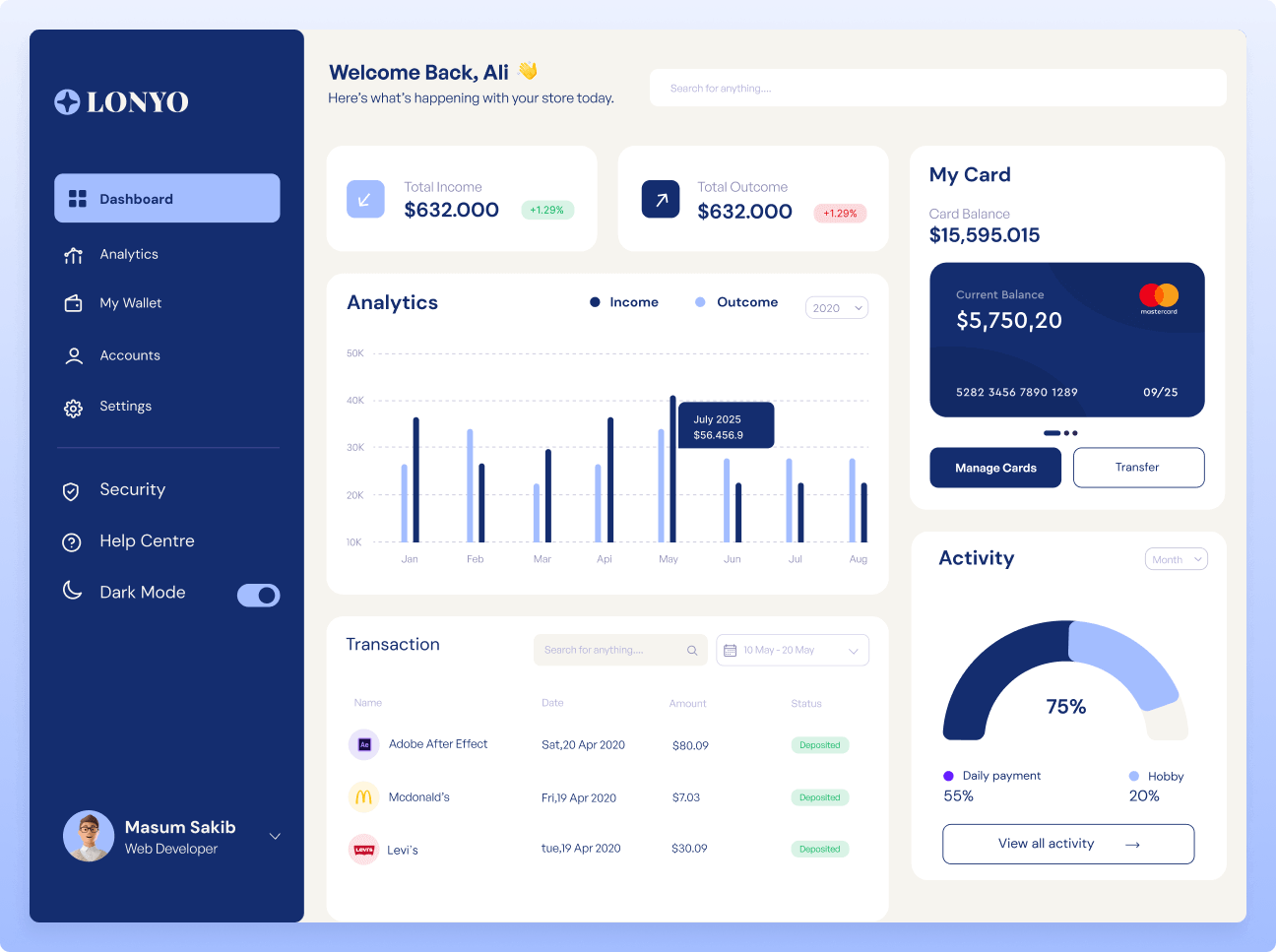

Expense tracking is a core feature of finance apps that helps users monitor and categorize their spending. It provides a clear picture of where your money goes, enabling smarter financial decisions and better budgeting.

1. Automatic Transaction Syncing: Link your bank accounts and credit cards to automatically import transactions in real-time.

2. Categorization of Expenses: Transactions are sorted into categories like food, transportation, utilities, and entertainment, making it easy to understand spending patterns.

3. Customizable Categories: Create custom categories tailored to your lifestyle for a more personalized tracking experience.

4. Spending Trends Analysis:Get insights into your spending habits through monthly summaries, trends, and charts.

5. Searchable Transaction History: Easily find past transactions with a searchable history, ensuring you never lose track of specific expenses.

Integration Feature means any Service feature that collects metrics by means other than through an OSCI, has an interface for displaying information collected via an OSCI that is separate from the Service's or exports metrics to other Google or third party products or services.

Whether you're managing personal finances or tracking business expenses, an expense tracking service ensures you stay on top of your financial goals effortlessly.